Always chasing high school quilts? Maybe you haven’t understood the rules of the game of smart funds

- 2025年6月5日

- Posted by: Eagletrader

- Category: News

If you want to understand the operating logic of the market at any moment, you must understand the behavioral motivations of large participants. The three stages of the market – accumulation, manipulation and distribution – constitute the core path of “smart capital” trading behavior. This analysis method originated from Richard Wikoff

Wyckoff) theory emphasizes that the cyclical nature of the market is driven by institutional behavior.

However, classic Wickov’s interpretation of accumulation and distribution is slightly different. For some traders, identification and application are still challenging. In recent years, with the prevalence of market structure trading, AMD Trading Method (or ICT)

The Law of the Three Forces) has gradually become an easier choice to practice.

What is AMD Trading Method?

AMD(Accumulation, Manipulation, Distribution) Trading Method, by Trader Michael J. Huddleston

Promotion is a simplified and practical version of Wyckoff’s theory. This method is widely applicable to high-liquid markets such as foreign exchange, index, and cryptocurrency. The core lies in identifying three major stages of large-scale fund management positions:

Accumulation stage: quietly building positions in a specific price range;

Manipulation stage: induce retail investors to stop losses or chase orders, and guide the market to misconceptions;

Distribution stage: The direction is reversed, institutions cash in profits, and prices move significantly in a favorable direction.

This process is often accompanied by systematic manipulation of retail investors’ emotions: not only lie to you to enter the market, but also to stop loss. Understanding the structural logic behind these three stages is the key to identifying trading traps and formulating high winning strategy.

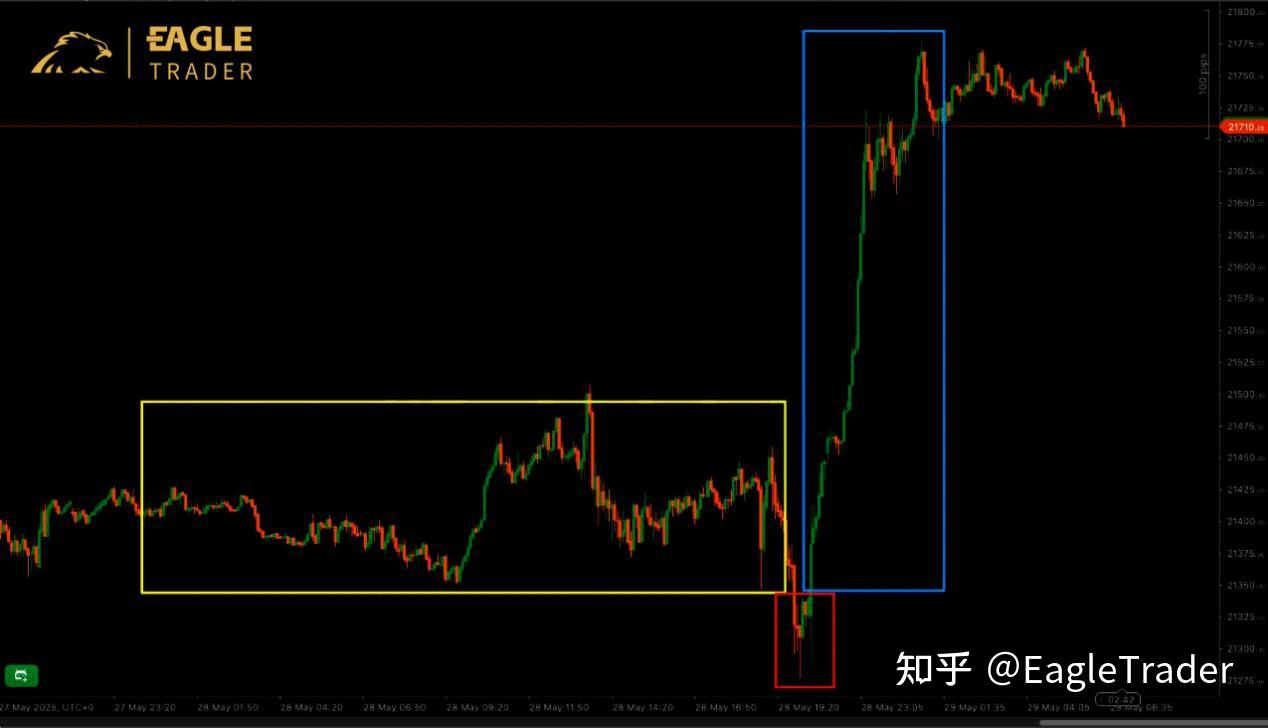

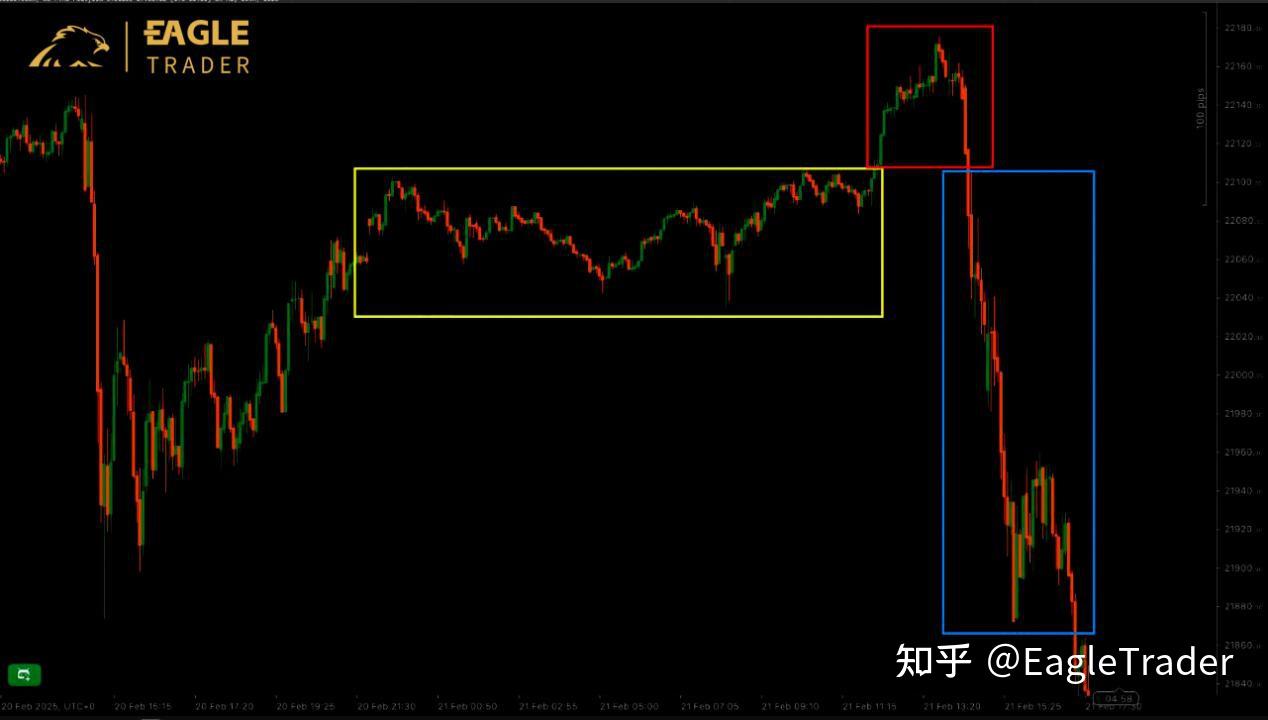

Accumulation stage

This stage is usually manifested as consolidation, and prices fluctuate repeatedly within a narrow range. Retail investors often try to short at the top of the range, try to long at the bottom, and set stop loss outside the range. At this time, the trading volume is sluggish and the volatility converges, which makes people misjudged as lack of opportunities.

But it was in this silence that “smart funds” began to quietly build positions and lay out for the next big move.

Manipulation phase

When the position is ready, “smart funds” will suddenly increase the volume to push the price, forming a “false breakthrough” market. Retail investors were swept to stop losses and wrongly chased orders, and the market fell into chaos.

This is a psychological war. Retail investors make emotional decisions in a short period of time, either being swept away by losing money or having a reversal of position direction, and falling into a deeper trap.

Distribution stage

In the final stage, the price moves violently in reverse and trading volume surges. Institutions take advantage of the situation to distribute positions, and prices will move in a favorable direction.

The large number of retail investors who were lured into the manipulation stage, and the stop loss was triggered at this stage, becoming the source of liquidity for institutions. This stage is usually the longest-lasting and most clear-cut part of the three stages, providing traders with the best risk-reward ratio.

How to actually use the AMD method?

AMD

The core of the trading method is to identify the market stage and understand structural changes, especially: identifying large structures through high time frames (such as daily lines, H4); observing specific consolidation, breakthroughs and structural changes in short cycles such as M15; paying attention to the “false breakthrough” behavior near key prices, trading volume changes and order block positions; avoiding attempts to trade all stages, and the entry signal in the distribution stage is most valuable.

However, there is still a long way to go between truly “understanding” and “doing right”. The cultivation of market intuition is inseparable from the accumulation of a lot of experience and repeated trial and error.

Solve trading intuition in a simulated environment

The “Smart Fund” trading method has high requirements for traders’ structural judgment and psychological quality, and this needs to be formed in a large number of practical battles. But for most traders, it is too expensive to try and make mistakes directly in the real-time market.

At this time, a more cost-effective option is to use the simulated assessment mechanism of the proprietary trading platform. With EagleTrader

For example, traders can practice strategies repeatedly in demo accounts without deposits and accept tests in strict risk control and real market environments. After passing the assessment, excellent traders can sign contracts with the platform and obtain up to 90% of the profit share.

This path not only helps traders verify their strategies and strengthen their execution, but also greatly reduces theirTrial and error costs lay the foundation for professionalization.