EagleTrader Statement: Why are candidates strictly prohibited from trading in related accounts?

- 2025年6月3日

- Posted by: Eagletrader

- Category: News

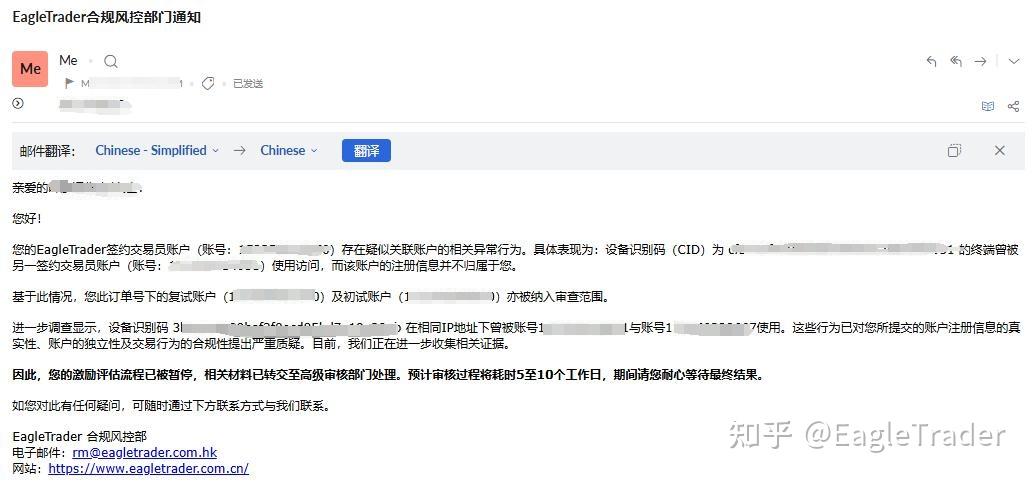

Yesterday, several candidates claimed that EagleTrader did not pay their due profits according to the rules. However, after strict review by the platform’s compliance risk control department, a number of evidence was found to prove that there were serious violations of related accounts in the accounts under his name.

Initially, the platform passed the incentive fund application for candidate Y and found that the account under his name had cross-access records with the registration information of other candidates.

(EagleTrader first email notification image)

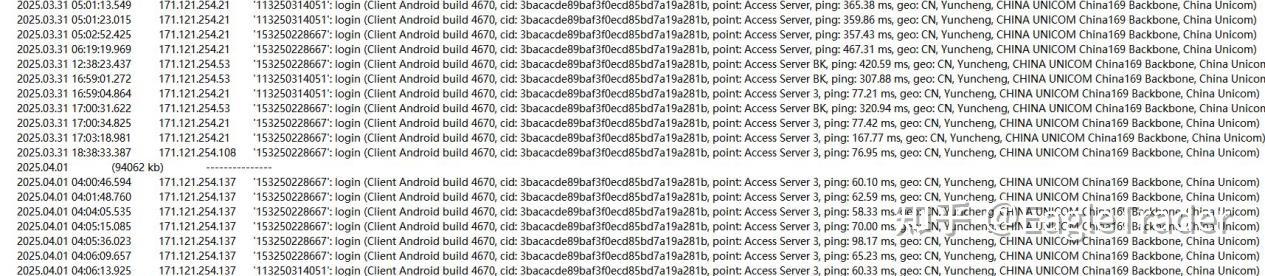

In further investigation, the platform found that candidates Y and candidates L had frequent access records under the same device code, and the account operations of the two were highly consistent.

(Frequent access record of candidates Y and candidates L under the same device code)

(Frequent access record picture of candidates Y and candidates L under the same equipment code)

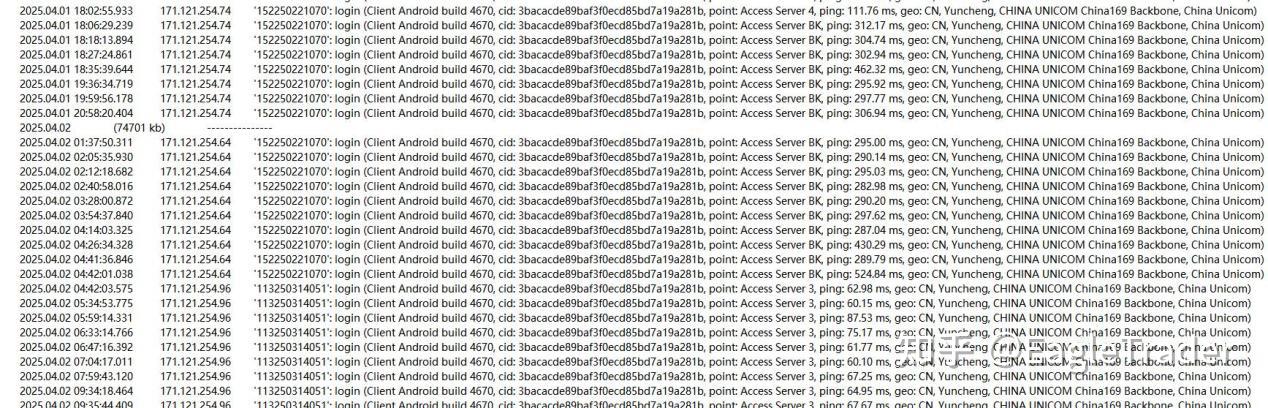

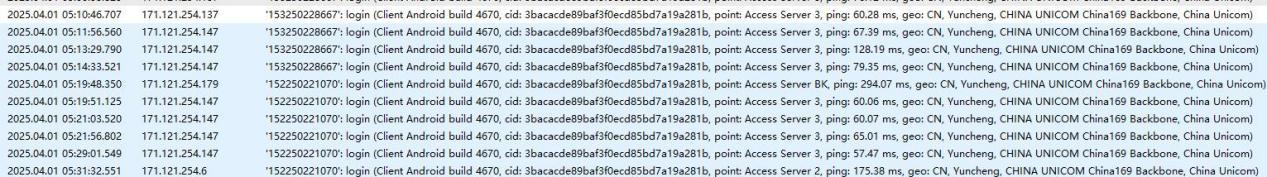

After in-depth investigation, the platform further found that there were also cross-visit issues between candidates L and candidates H. At the same time, there are also cross-access cases for the accounts between candidates Y and candidates H. This series of related access behaviors aroused the platform’s alertness and conducted a more detailed investigation.

(Cross-access diagram of the contracted trader accounts of candidates L and candidates H under the same device code)

(Collection Y’s re-examination account and candidate H’s first contracted trader account under the same device code)

(The cross-access diagram of the contracted trader account of candidate Y and the first contracted trader account of candidate H and the same device code)

Through in-depth analysis of trading data, the platform also found that the similarity between candidate Y and candidate H is extremely high, especially in key parameters such as closing time, opening product, stop-profit and stop loss settings, which are almost completely consistent.

The high similarity of these orders far exceeds the accidental coincidence in the market, and evidence indicates that there are obvious related transactions in these accounts.

(Affiliated delivery form between candidates Y and candidates H)

Combining the above related evidence, the platform determined that these transactions have far exceeded the scope of market coincidence and constituted serious related transactions. In order to ensure the fairness and impartiality of the exam, the platform suspended the examination qualifications of these candidates in accordance with relevant rules and took corresponding measures to the relevant accounts.

Related account transactions are strictly prohibited

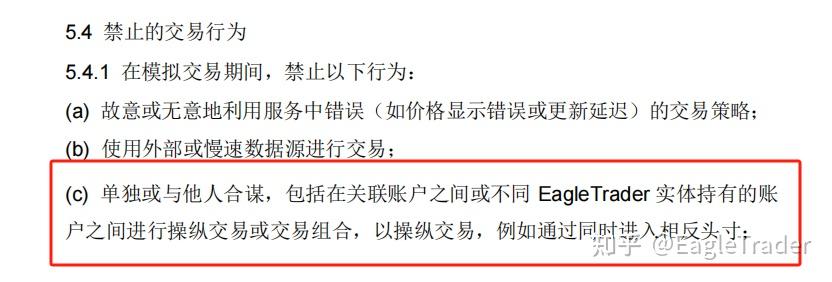

EagleTrader examination rules clearly stipulate that any form of related account transactions are strictly prohibited.

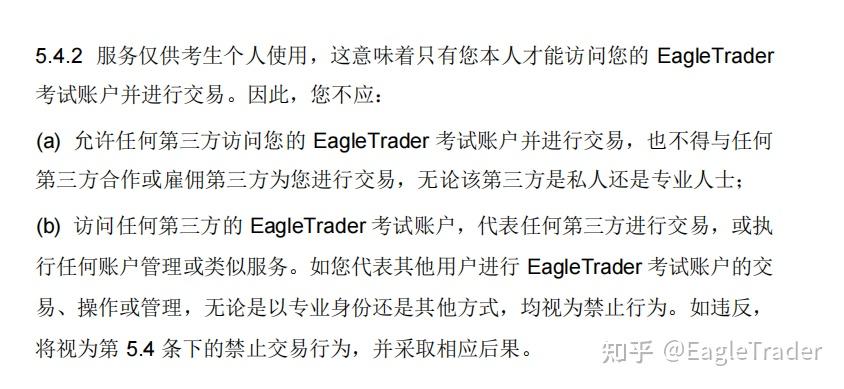

The “EagleTrader General Terms and Conditions” and “EagleTrader” signed by candidates when registering when signing up

In the Supplementary Terms of the Trader Examination Rules, it has been emphasized many times that candidates are not allowed to provide or share login credentials to third parties, and transactions in related accounts are strictly prohibited.

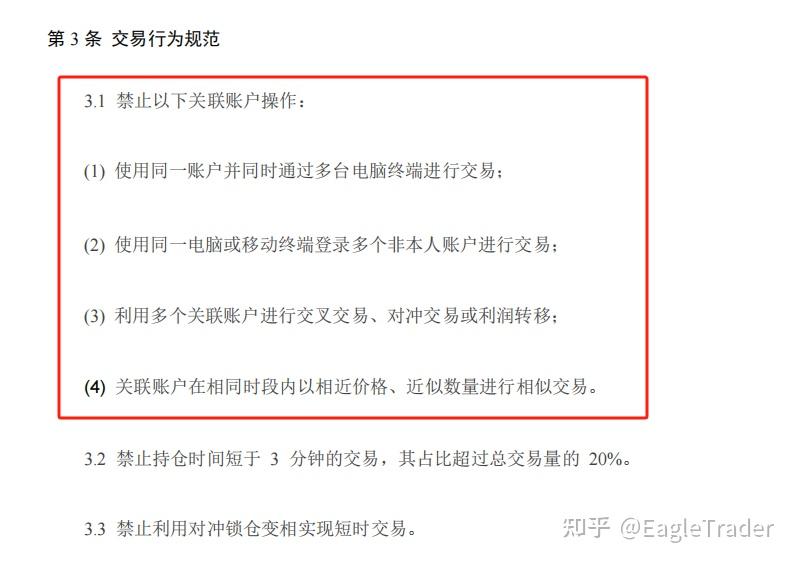

The specific terms are as follows:

<img alt="" src="https://www.hudianbaoseo.cn/uploads/allimg/20250603/1748914349210492.jpg" width="654" height="170"//

(Article 4.3 of the EagleTrader General Terms and Conditions)

(Article 5.4.1 of the EagleTrader General Terms and Conditions)

(Article 5.4.2 of the EagleTrader General Terms and Conditions)

(Article 3.1 of the Supplementary Terms of the EagleTrader Trader Examination Rules)

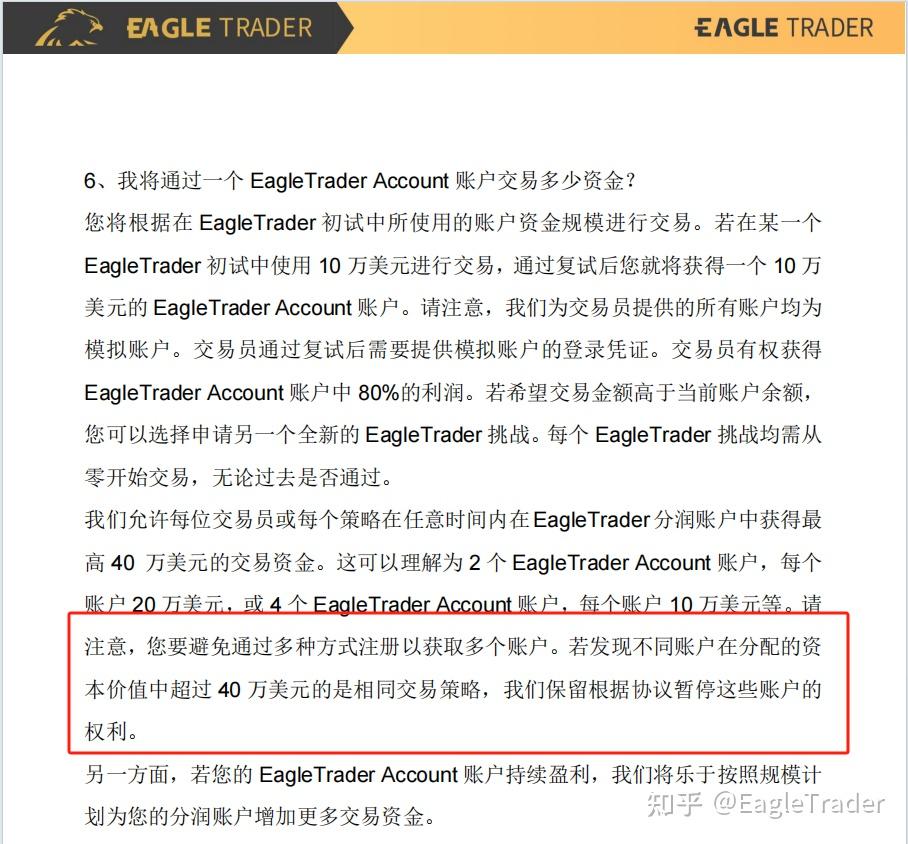

The attached “EagleTrader”

The relevant examination rules are also listed in detail in the FAQ document. We clearly require that candidates should avoid registering through multiple ways to obtain multiple accounts. If you find that different accounts have more than $400,000 in the allocated capital value, it is the same transaction policy.Omittedly, we reserve the right to suspend these accounts under the Agreement.

(“EagleTrader FAQ” Section 2, point 6)

The core purpose of the EagleTrader exam is: not only recruit outstanding traders, but also committed to incubating top traders around the world.

This concept aims to provide every candidate with a platform to demonstrate trading ability, ensure that they demonstrate their true trading level in a fair environment, and improve their abilities through the exam.

However, the transaction behavior of related accounts violates this original intention and will not only affect the fairness of the exam, but may also be used by individual candidates to avoid rules and disrupt normal examination order. In order to ensure a level playing field for all candidates, we strictly prohibit such behavior.

Why does EagleTrader prohibit related account trading?

1. Ensure trader independence

The goal of the EagleTrader exam is to evaluate traders’ independent trading capabilities and strategies. If candidates cooperate through related accounts, they will not be able to accurately evaluate their personal trading capabilities. Therefore, independence is a basic requirement of our exams, ensuring that every candidate makes decisions through his own judgment and strategies.

2. Strict implementation of guarantee rules

The rules design of the EagleTrader exam is designed to examine how traders manage risks and funds within a strict risk control framework. Related transactions may be used to avoid risk control rules, such as reducing risks through mutual cooperation or creating false profits, which does not meet our requirements for fairness and transparency.

3. Cultivate real trading capabilities

We hope to help traders improve their real trading capabilities through the EagleTrader exam, especially emotional management, risk control and fund allocation. Related transactions may conceal the candidate’s actual ability and make him seem to perform well in the exam, but this is not conducive to his long-term development.

By strictly limiting related transactions, we ensure that the exam truly reflects the trader’s comprehensive abilities, helping them identify and improve trading strategies, so as to achieve better results in future trading.

In addition, this measure also helps the platform maintain a fair and transparent trading environment and avoids unfair influence on other traders.

For this incident, EagleTrader has always adhered to the principles of strict rules and fairness and transparency, and has zero tolerance for any violations. We attach importance to the integrity and trading performance of every trader, and resolutely safeguard the fairness of the platform and the fairness of the exam.

All candidates are also asked to remember that abiding by platform rules is not only the basis for participating in the exam, but also the prerequisite for obtaining profits and demonstrating trading ability. Any violation of the rules will directly affect your personal interests and may even lead to the cancellation of the examination qualification.

We look forward to every candidate showing his real trading ability in a fair and just environment and truly becoming a top trader!