Focus on improving trading capabilities! EagleTrader simulated trading system creates a new path to trading growth

- 2025年5月27日

- Posted by: Eagletrader

- Category: News

In the context of intensifying global market volatility, the challenges faced by traders are no longer limited to the technical analysis level. Many traders often make decisions due to emotional interference in real-time operations. How to build a scientific trading psychology and risk control system has become the focus of industry attention.

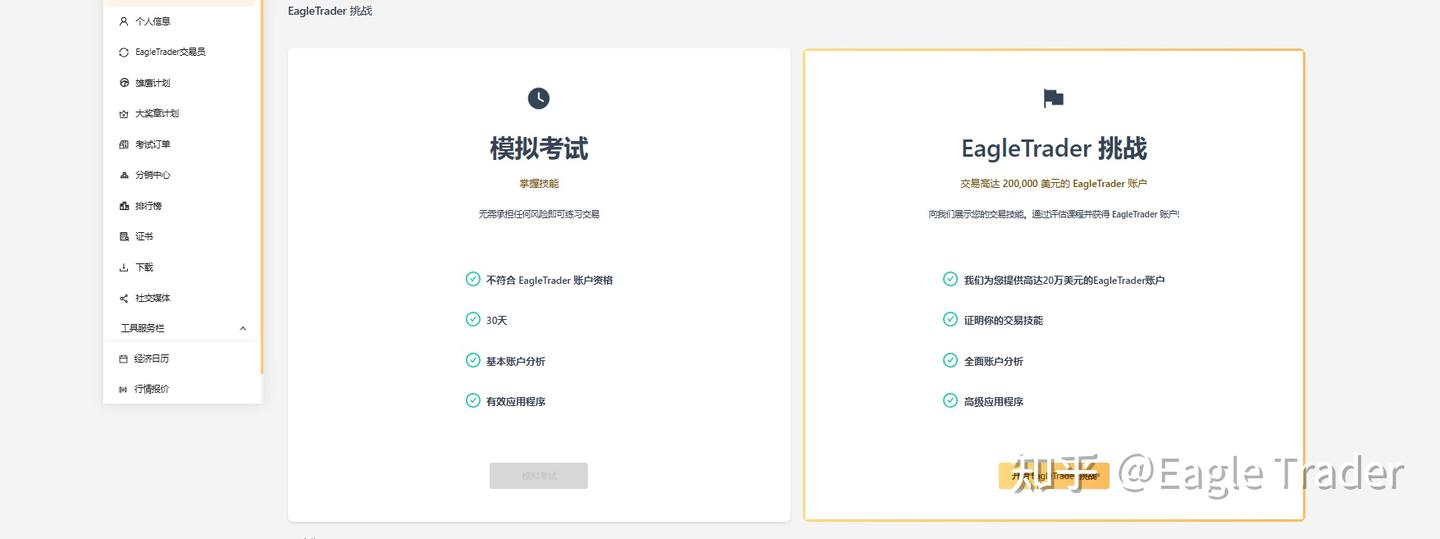

Domestic self-operated trading exam EagleTrader uses its own developed simulated trading system to provide innovative solutions to solve the pain points of this industry.

Farewell to the financial pressure

EagleTrader

The simulated trading system has changed the limitations of the traditional assessment model and built a complete trading growth path through unique mechanisms. EagleTrader provides simulated trading accounts that are exempt from the entry threshold, allowing traders to focus on strategy polishing in a stress-free environment. This method has changed the trading mentality impact caused by funding problems

——Let traders be freed from the anxiety of paying attention to account numbers and truly focus on the optimization and execution of trading logic.

Simulate real market fluctuations

Secondly, the system accesses global mainstream market data in real time, with 1:1

The proportional replicates the real-disk fluctuation scene. This highly realistic market environment can not only help traders adapt to liquidity shocks and breaking news events in real trading, but also cultivate their keen perception of market rhythm through immersive practical trading, allowing traders to continue to hone and grow in the real market.

Risk Control Management

EagleTrader exam focuses on cultivating traders’ trading discipline. Through the system dynamically monitor traders’ position changes, profit-to-loss ratio, maximum drawdown and other key indicators, and conduct behavioral evaluation in combination with preset professional trading rules.This evaluation method that combines quantitative and qualitative can not only promptly correct irrational behaviors such as excessive trading and persistent losses, but also help traders gradually develop good and professional trading habits.

Trader incentive mechanism

In order to encourage traders to continuously improve their trading capabilities and promote their professional growth, EagleTrader has launched a step-by-step incentive mechanism:

Profit sharing: After passing two rounds of assessment, it can withdraw 80% of the net profit of the account.

Eagle Plan: Entering the Eagle Plan, the profit share ratio will be increased to 90% + the profit share cycle will be shortened to 14 days

Medal Plan: Entering the Medal Plan, you can get 2 years of high-paying labor contracts + up to $1 million to simulated trading account

Fund Manager Offer: The best traders can be invited to join EagleTrader Asset Management

Limited’s professional team becomes a professional fund manager and manages a larger scale of funds.

The EagleTrader exam not only undertakes the core mission of selecting outstanding traders, but also is committed to building a sustainable trader training ecosystem. Through the seamless connection between simulated trading and real markets, the platform provides traders with full-cycle support from strategy verification to psychological toughness system training. Just like EagleTrader’s brand statement – “Incubate the world’s top traders!”

As the degree of professionalism of the trading market continues to increase, the requirements for the comprehensive quality of traders are becoming increasingly stringent. The EagleTrader exam also provides traders with a different path to career advancement.