If the market changes suddenly, will you be “ambushed” by the market or will you defeat the enemy by the backhand?

- 2025年6月10日

- Posted by: Eagletrader

- Category: News

In the trading market, the so-called “black swan” is actually not uncommon. Economic data release, geopolitical influence, sudden speech of the central bank… These events are enough to cause the market to fluctuate violently within a few minutes, and to allow traders who are not in place to manage their positions to explode instantly.

When encountering sharp changes in market risks and sentiment, many people find that their strategies are not in time to adjust, and the graphical analysis is completely ineffective, and even the most basic stop loss cannot be triggered.

The problem lies not in technical errors, but in the fact that most traders are not ready to “face the unknown.”

The psychological mechanism of “ambushed by the market”

In fact, it is normal to be “taken off guard” by the market. Even experienced traders will have a “freeze reaction” in the face of bursting news – hesitating, hesitating, and even giving up operations altogether.

Psychologically, this is called “acute stress response” (Acute Stress)

Response) is a defensive state that the brain automatically enters when facing high pressure and unknown conditions. This situation is often seen in martial arts training: students who are quick-responsive in class are frozen and motionless when they are suddenly attacked by someone on the street.

Why? Because they have never really trained their ability to make quick decisions in unexpected scenarios. This is very similar to a transaction.

How to train the brain that “faces accidents”

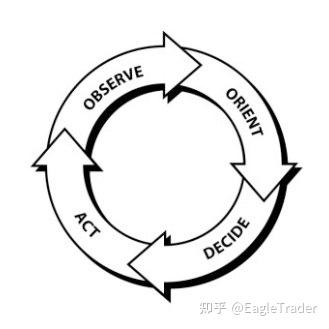

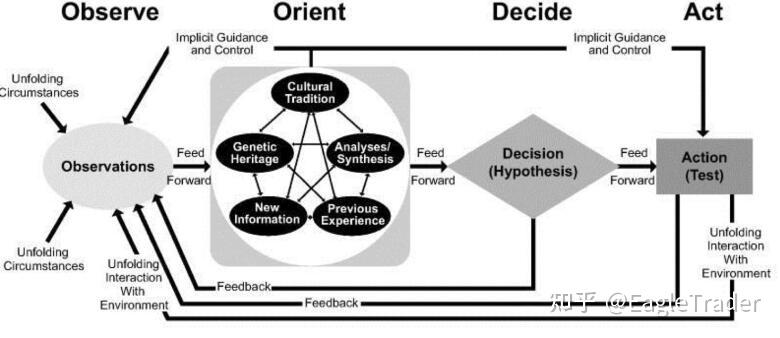

The OODA loop proposed by US Air Force tactical expert John Boyd provides us with an extremely practical thinking model:

Observe(observe): Receive market mutation signals (K-line abnormal movement, early data leakage, etc.)

Orient(judgment): Based on past experience, quickly judge the nature of mutations

Decide(decide): Decide at the current stop loss, increase position or wait and see

Act(action): execute the decision quickly to avoid emotions taking the dominance

For example, when you set a strategy to open a position after non-agricultural, but the data is far from the expected result, the market fluctuates violently before expectations. If you have trained this kind of sudden script, you will know to pause the order and observe market sentiment first; otherwise, you can only watch the system automatically complete the transaction, dragging you into a situation where you shouldn’t be.

Training Suggestions:

Use historical markets to do “situation simulation” exercises

Add to add a question about “If the market suddenly reverses, how will I deal with it” in daily review

Add to the trading system to deal with emergencies

In the face of unknowns, establishing a reaction system is the trump card

Dr. Brett Steenbarger said in “Improving Trader Performance”: “We cannot respond well in advance in the situation we have never imagined.”

Many traders fail not because of poor skills, but because they cannot make decisions under pressure. The fundamental reason for not being able to make decisions is that the brain has never been trained in an “unexpected situation”.

You certainly cannot predict all emergencies, but you can prepare for an accident. Through situational drills, system rule optimization, and simulated pressure decisions, you will gradually have a stable internal system and no longer be led by the market’s unexpected rhythm.

The market will continue to “ambush” us, but have you started to train yourself to deal with unpredictable challenges under real risk control?

This may be the choice of many traders

The reason for the EagleTrader self-operated trading exam. Trading in the platform simulated fund account tests not only the strategy, but also the trader’s ability to adapt to restrictions, psychological pressure and sudden market conditions.

Real training is never just about reviewing the market conditions that have been known in those few days, but about the moment when you can make clear decisions between rule constraints and unexpected blows.

Don’t wait for the market to take action before you find yourself unprepared. The more realistic the training, the more stable the trading can be.