Not relying on principal, but on ability: How can the self-operated trading exam provide traders with career opportunities?

- 2025年5月27日

- Posted by: Eagletrader

- Category: News

In the trading circle, there is a phenomenon that is gradually attracting more people’s attention: why do a group of traders who are clearly capable of running real-time trading choose to take the “demo account” exam?

No account custody, does not involve fund custody, and does not require deposits. They place orders in the market every day, but their trading accounts are not real-time, but they can really get profit sharing. Some people laughed and said it was “simulated to make gold in the simulation”, while others asked vigilantly: “Is this a capital change to skin, or is it a new bottle of old wine?”

If you are also hesitant about the self-operated trading exam, then today’s article may help you find the answer!

The self-operated trading exam is not a capital allocation transaction

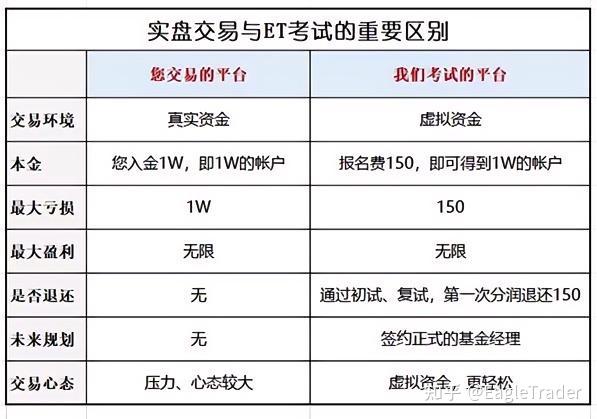

In many traditional understandings, “using other people’s money to trade” is often equated with “capital allocation”: high operational risks, high costs, and self-paying profit and loss. The concept of self-operated trading exams is just the opposite.

At EagleTrader, traders do not need to pay principal, bear losses, and bear interest costs. The only thing you need to hand over is your respect and execution of trading rules.

EagleTrader uses a simulated trading account based on real market conditions, which is a virtual fund provided by the platform. The transaction process is completely completed in a simulated environment and does not involve actual capital investment.

Traders only need to use their own strategies and systems to complete trading goals within the specified time. The platform will evaluate whether to grant profit-sharing qualifications based on dimensions such as income, retracement, risk control performance.

This process does not rely on luck at all. Every profit share you get is behind the assessment of the simulated trading system and the reflection of your trading ability.

The “real profit sharing” mechanism behind the demo accounts

Many people have natural distrust of the demo accounts—not real money, how can there be real returns?

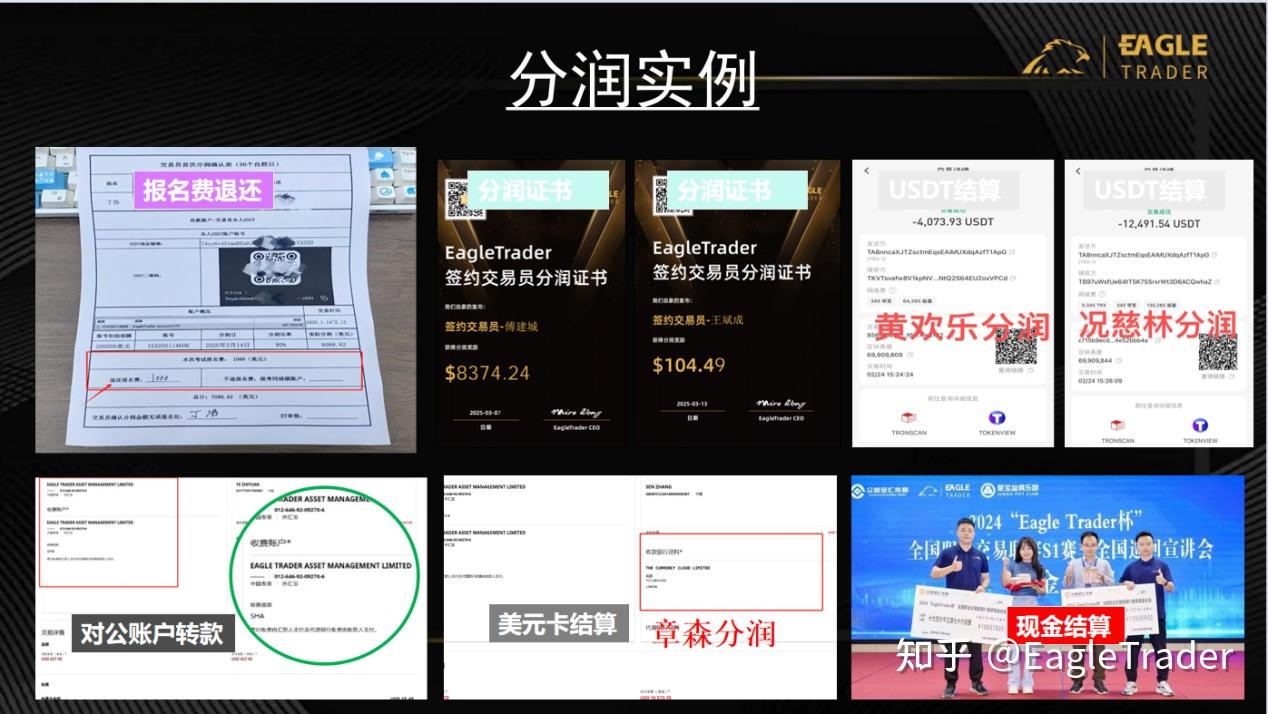

But in fact, although the self-operated trading exam uses a demo account, after passing the assessment, traders can still obtain up to 80% of the profit sharing based on the actual profit results.

In other words, although the transaction operation is still in a simulated environment, EagleTrader

Real returns will still be given based on trading performance – this is a recognition of capabilities and an incentive mechanism specially set by the platform for excellent traders.

Go to the next level, for traders who perform well and have mature risk control systems, EagleTrader will also give fund manager-level professional offers to help them truly enter the path of professional trading.

This may sound like a paradox: you do not take financial risks, but you have obtained substantial returns from “real-like trading”, and may even embark on the path of professional trading.

But for EagleTrader

In other words, the significance of this mechanism is clear: by simulating risk control restrictions in the real-time trading environment, traders are encouraged to cultivate long-term and stable profitability, and provide positive incentives in a systematic way.

For traders, this is not only a low threshold to enter professional trading, but also a display of ability without using personal funds but the results are real.

The difference between real and real trading is not true or false, but in the path

Some traders say that the self-operated trading exam is a “rehearsal of professional trading.”

This statement is not an exaggeration. Traditional real-time trading means that you have to use your own money to bear uncertain volatility, emotions, costs and emergencies. In the face of financial pressure, even excellent trading strategies may be disturbed by emotions and human nature.

In the self-operated trading exam, what you are facing is a more institutionalized and regular trading environment. You cannot have a heavy position at will, you cannot lose your position at will, or you cannot bet on unilateral market conditions. These restrictions seem to restrict freedom, but in fact they force you to move towards a more mature trading path.

It forces you to establish a trading system, formulate risk control logic, track account data, and review your own decision-making errors. It is not a place to “exert inspiration”, but a field to train you to be disciplined, systematic, and compound interest awareness.

So it is not a replacement for the real market, but a supplement to the training shortcomings that traders lack outside the real market.

Now, more and more traders are starting to actively sign up for the self-operated trading exam, not because they do not have real-time trading ability, but because they are beginning to understand: on the road to real-life trading, can they stabilize themselves and make a big profit?, more important.

You don’t need to take out your principal to test whether your system is stable; you don’t have to gamble on savings to get a share of your income; you no longer need to look for funding parties everywhere, but speak on your own achievements.

This industry is ultimately the one who is willing to turn “ability” into “long-term results”. If you are willing to use the time of two rounds of exams to verify your trading logic, maybe you will find: No

EagleTrader filters you, but you choose a starting point that suits you more!