Self-operated trading exam standards description: Why does EagleTrader design the assessment process like this?

- 2025年8月7日

- Posted by: Eagletrader

- Category: News

Before participating in the proprietary trading exam, many traders will ask a question: “Why should we set a fixed profit target? Why are daily losses and maximum drawdowns so strict?”

This question is not surprising. For many people who are accustomed to free trading, fixed profit indicators and rigid risk control red lines seem like an unreasonable threshold. However, in the self-operated trading exam, such standards are not artificially set up cards, but rather a mapping test of real trading capabilities.

This article will explain the true intention behind each assessment indicator based on the three-step process of the EagleTrader self-operated trading exam.

From the initial examination to split the profit, each has its own focus

EagleTrader’s self-operated trading exam is divided into three stages: preliminary examination, re-examination and contracted traders. The setting of each stage is closely centered on the “core abilities that proprietary traders should possess.”

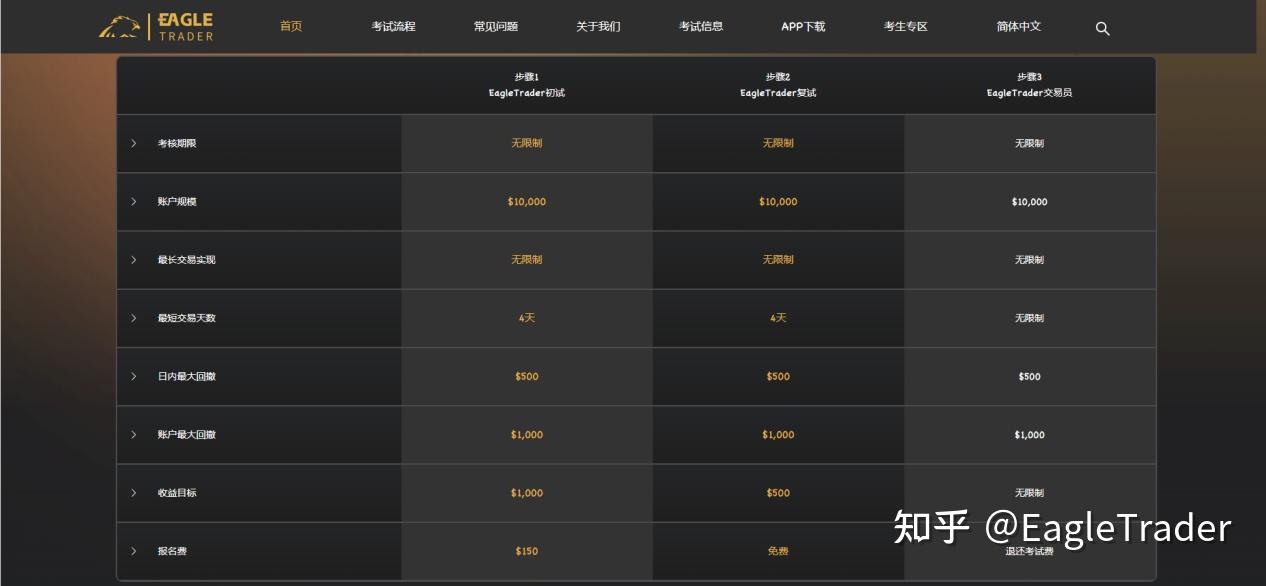

The initial examination requires the account to achieve 10% profit. During the period, the red line of the maximum daily loss of 5% and the total account loss of 10% shall not be triggered. The minimum trading is 4 days;

The profit target of the re-examination is reduced to 5%, and the risk control standards are the same, and it also needs to cover at least 4 trading days;

When you pass the first two rounds of assessment, you will become an EagleTrader contracted trader. There is no limit on the profit target and time, and the risk control standards are still maintained. Traders can enjoy 80% of the profit share.

Many people will be curious: Why is the profit target a hard requirement of “must be achieved” in the first two rounds? Why can’t the risk control red line be loose at all?

In fact, these two dimensions examine the “offensive power” and “defense power” of the trading system respectively. If the trading strategy does not have enough profitability, it cannot support account growth; and if it is out of control and drawdown, the best system will fail. This is also why this set of assessment standards is regarded as the most effective way to incubate professional traders.

Set profit targets

In most traditional recruitment systems, traders often use resume transcripts orPast real-market earnings to prove their ability. But in reality, a profit at one time does not mean a stable profit, and the luck component cannot be ruled out. Especially the “short-term outbreak” in some extreme market conditions, the quality of the strategy itself is almost impossible to verify.

EagleTrader

In the examination setting, the initial test goal is 10% profit, which is not high, but to complete it under strict risk control, you must have certain strategic logic, execution ability and market judgment. This is not a game of betting on one go, but an assessment of the “continuity” and “structural” of trading behavior.

The re-examination lowered the profit target to 5%, but required traders to achieve the target again under the same risk control constraints. This change is not to reduce the difficulty, but to switch the evaluation dimension: explosive power of the preliminary examination and stability of the re-examination. Through this combination of examinations, traders who “is complete or not” and “having the ability to continue to play a role in different environments” can be effectively identified.

Simply put, the existence of profit targets is to avoid “lucky players” who stand out by just one market burst, and to select traders who truly have the ability to drive logic and reproduce profits.

Rigid loss limit

Compared with the profit target, the daily loss of 5% and the maximum loss of 10% are often more likely to cause controversy. Some traders may think, “Isn’t such a tight risk control restriction disguised as a disguised person?”—

In fact, it’s the opposite.

This risk control framework is not a restriction, but a restoration of the lowest-level logic of real self-operated transactions.

In proprietary trading, traders do not operate their own funds, but simulated funds. The first requirement of this role is not to make quick profits, but to learn to keep the principal. The daily loss of the account cannot exceed 5%, which is to prevent a fatal blow from being out of control during market fluctuations; the maximum drawdown is controlled at 10%, which is to draw an “stop loss line” that cannot be broken through during the entire assessment period.

The real professionalization of trading is not how smart the strategy is, but whether you have the ability to “hold it” in bad markets and not collapse. Many traders have experienced a stage: the strategy written looks perfect, but when actually operating, they are reluctant to cut the stop loss and are unwilling to accept the withdrawal. The rigid setting of the loss line in the assessment is to force trading discipline with consequences.

In other words, the risk control line is not a “block” set by the platform, but a “bottom line awareness” that traders must establish. If a trader cannot strictly manage risks during the simulation stage, then hand over the real funds toHis operations are extremely irresponsible for the funds.

Minimum trading for 4 days, no time limit

In addition to profit and loss targets, the setting of “minimum trading for 4 days, no time limit” in the examination process is also worthy of special explanation.

This arrangement essentially gives traders enough flexibility. It does not require you to trade every day, nor does it restrict you from completing your exam goals quickly, but encourages traders to arrange operations with the pace of strategy as the core. For example, some may choose to control positions and wait for opportunities in a volatile market; some may concentrate their firepower to seize a strong trend, both of which are allowed.

The “minimum 4-day trading” is set to observe whether the trading system is reproducible and not to “get away” because of a successful speculation. Without setting a time limit, it reflects respect for the differences in trading rhythms and does not forcibly integrate short-term and medium- and long-term trading styles.

For traders who have already formed a personal style and have a clear trading cycle, this flexible design is a professionalism rather than a restriction.

The core of the self-operated trading exam

If you go back to the most essential question of trading: “Can you make steady profits without breaking your position?” Then EagleTrader’s examination system is actually a simulated solution to this problem.

The 10% profit target is not temptation, but a verification. The 5% daily loss line is not a punishment, but a preview.

Strategic logic, risk control, trading rhythm, all these abilities will eventually be reflected through the double restrictions in this exam.

For truly capable traders, this structured screening is actually an opportunity to show fairly.

Any set of trading assessment standards will ultimately guide traders to form a certain behavioral model. EagleTrader sets “profit target +

The combination of risk control red lines is essentially to guide traders to a professional state:

It is not for short-term outbreaks, not for huge profits and high drawdowns, but for establishing a long-term profit system under reasonable risks.

For traders, passing such an exam is not only a qualification to share capital, but also a change in thinking from amateur games to professional operations in practice.