What advantages does the EagleTrader exam bring to traders that cannot be experienced in real-time trading?

- 2025年5月27日

- Posted by: Eagletrader

- Category: News

In most traders’ daily trading, real-time trading is the normal choice for trading: deposit money through brokerage platforms and use their own funds to trade. Each order is directly related to the profit and loss of their own principal. Therefore, it brings psychological pressure and financial risks, which are huge, especially for novice traders, who are often prone to making irrational decisions due to emotional fluctuations.

In contrast, the EagleTrader exam not only does not require real capital investment, but also sets a trading environment that simulates the real market, allowing traders to focus on strategy optimization and psychological quality improvement without taking financial risks. Although both involve market analysis and decision-making execution in form, the core difference between the two lies in the management of risks and psychological pressure.

Challenges of Real-Trading

Live-Trading is a model that most traders are familiar with, where traders use their own real funds to trade in the market. Although this can bring high returns, it also comes with huge risks and challenges.

Fund Risk

In real trading, each transaction directly affects the trader’s capital status. If the market volatility is unfavorable, traders may suffer losses, or even lose all their funds. This economic pressure is often a major challenge in the decision-making process of traders. Many times, the loss of funds is not only a financial loss, but also a huge psychological blow.

Emotional Management

In real trading, emotional fluctuations are very likely to affect trading decisions. Traders may miss opportunities because they are afraid of losses, or they may impulsively increase positions due to continuous losses and try to “turn the tables”. This emotionally driven decision is also one of the root causes of losses. Moreover, traders often pay too much attention to the current profit and loss, and it is easy to ignore long-term planning and reasonable risk control.

Security of securities platforms

Another challenge that cannot be ignored in real trading is the security of securities platforms. At present, many brokerage platforms on the market do not have sufficient financial security and transparency. Once there is a problem with the platform, traders may face the inability to retrieve funds or passive losses.Risk of losing all funds. Especially some platforms have frequent incidents of storm, which not only causes traders to lose all their principal, but also brings unbearable psychological blows. Therefore, choosing a safe and reliable platform is a major consideration that must be faced in real-time trading.

EagleTrader Exam

EagleTrader Exam is a self-operated trading exam, which mainly helps traders develop and improve trading skills through self-created simulated trading systems. Compared to real-time trading, it provides a safer environment that helps reduce external pressure and focuses on skills improvement.

Fundless risk

The biggest advantage of the EagleTrader exam is that it eliminates the risk of funds. Traders do not need to use real funds to trade, and mainly use simulated trading accounts provided by the platform, so there will be no financial burden whether they succeed or fail. This allows traders to focus more on strategy optimization and decision-making execution, without worrying about irrational decision-making caused by financial pressure.

Enhanced psychological quality

In the absence of financial pressure, the EagleTrader exam provides traders with an ideal trading mindset training platform. Traders can practice how to stay calm in a high-pressure environment during the fluctuations of the real market, how to overcome emotions such as greed and fear, and avoid emotional trading.

Trader Technical Suggestions and Guidance

EagleTrader will provide personalized trading reports to the risk control team based on the performance of traders participating in the exam in simulated trading. The report not only analyzes the advantages and disadvantages of traders, but also makes targeted improvement suggestions to help traders continuously optimize their trading strategies. Through this feedback mechanism, traders can not only improve their technical level in the exam, but also make more fully prepared for future real-time trading.

Profit share reward

Although the EagleTrader exam uses a simulated trading account, in order to motivate traders, the platform will give an 80% profit share reward for the profit generated by the trader’s account after passing two rounds of assessment. Traders can not only accumulate valuable experience in the simulation environment, but also earn real bonuses in simulated trading, further inspiring their motivation to participate and improve.

The core difference between the two

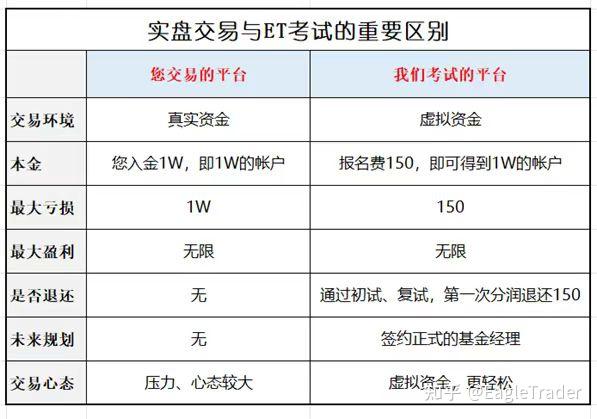

Although real-time trading and EagleTrader exams involve trading decisions and market analysis, they have significant differences in risks, stress, learning methods, and incentive mechanisms.

Risk and financial pressure: Real trading uses real funds, and traders’ trading profit and loss will directly affect the account balance, which makes traders suffer greater financial pressure and psychological pressure. The EagleTrader exam adopts a simulated environment, so there is no need to worry about capital losses. Traders can focus more on improving their own abilities and avoid emotional decisions.

Emotional management and psychological training: Fund fluctuations and losses in real-time trading may cause traders to fluctuate emotions and affect decision-making. The EagleTrader exam helps traders cultivate the psychological quality of responding to market fluctuations in an environment without capital risks and reduce mistakes caused by emotions.

Learning and feedback mechanism: Real-time trading requires long-term practice and trial and error, and accumulate experience slowly. The EagleTrader exam provides personalized Trading reports help traders discover problems in a timely manner, adjust strategies, and quickly improve trading skills. The guidance of the platform’s risk control team also allows traders to improve themselves more effectively in the short term.

Rewards and incentives: The returns of real-time trading rely entirely on market performance, and profits and losses directly affect income. Even if the EagleTrader exam is a simulated trading account, the profits and losses can be rewarded with 80% profit after two rounds of assessment, providing an actual incentive mechanism, allowing traders to achieve financial freedom in EagleTrader.

The biggest difference between real-time trading and EagleTrader exam is the management of risks and psychological pressure. Real-time trading requires traders to face the profits and losses of real funds, while the EagleTrader exam provides an environment without capital risks, allowing traders to focus on improving skills and training of psychological quality.

In terms of platform security, EagleTraAs an institution with licenses issued by the Hong Kong Securities Regulatory Commission, der enjoys stricter supervision to ensure the standardization and transparency of the operating mechanism. In addition, there is no need to deposit in the exam, so the risks of traders are greatly reduced.

For traders facing funding restrictions, technical bottlenecks, excessive trading pressure or lack of growth opportunities, the EagleTrader exam will be a rare opportunity.