What is the development prospect of proprietary traders? Why are more and more people involved?

- 2025年7月7日

- Posted by: Eagletrader

- Category: News

In the uncertain financial market, “making a living by trading” is still regarded as a high-risk choice, even with a bit of loneliness. But now, with the evolution of the trading environment and platform mechanism, the group of proprietary traders is quietly promoting changes in the industry – from marginalized individual speculators to gradually move towards a systematic and professional development path.

Professionalization of proprietary traders has become an industry trend

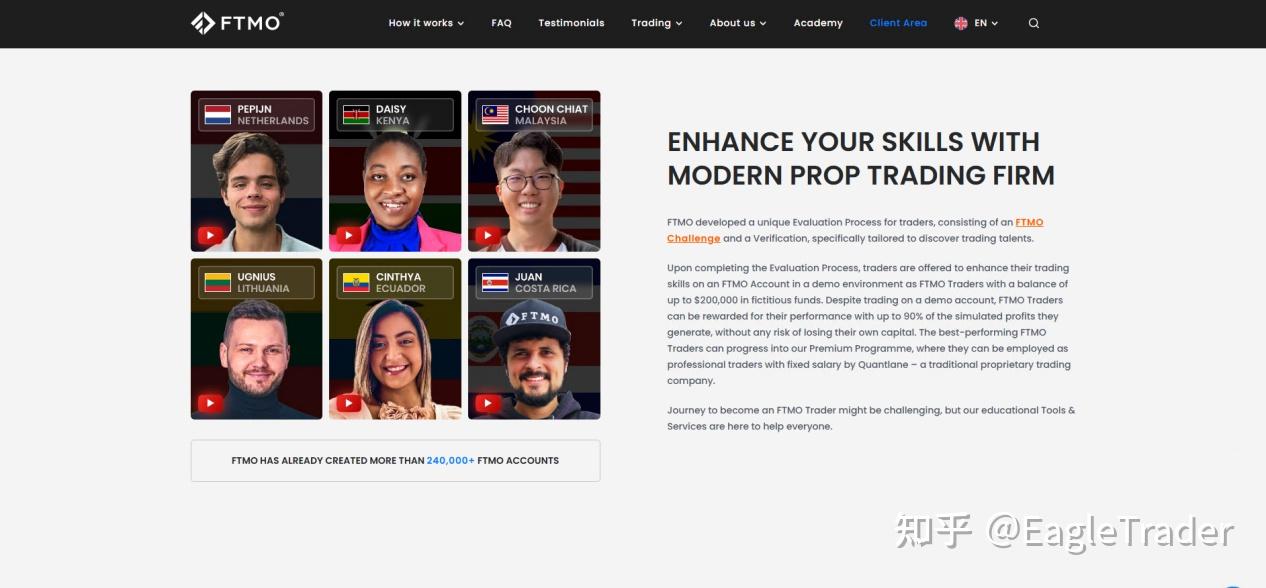

In the traditional financial industry, professional traders often rely on securities companies, funds or banks and other institutions. However, with the popularity of trading tools, the improvement of liquidity, and the innovation of trading platforms in fund management systems, more and more capable traders have begun to break free from institutional constraints and rely on the fund accounts provided by the platform to conduct independent trading.

Especially in the European and American markets, many professional traders have passed the “Prop”

Trading (proprietary trading) platform “completes career transformation: no need to bring your own funds, share profits according to performance, or even form a team. This mechanism with trading results as the core redefines the boundaries of professional traders.

A development path dominated by capabilities is opening

Compared with the trading path that used to be “piled out” by principal scale, today’s proprietary traders rely more on their own trading systems and risk control capabilities.

From contacting the market, establishing trading models, through trading assessments of proprietary trading platforms, to entering the high-scoring stage, and even obtaining professional positions given by the platform, the current path has gradually matured. It can be said that a stable profit trader is no longer out of reach from the start to professionalization.

Typical path schematic:

Simulation training → trading assessment → profit-sharing account → trading position/team cooperation → asset management

What the market needs is stable and replicable capabilities

The essence of proprietary traders is a direct game of risk and return. In the path of professional development, the market and platform value the following types of capabilities more:

Systemization strategy: Have clear entry and exit logic and fund management rules to avoid emotionally driven operations;

Risk control: Be able to withstand drawdowns and control the scale of losses, rather than

Stability and replicability: sustainable strategy, stable style, consistent performance;

Value data quantifiable: authentic and verifiable transaction data is the prerequisite for entering a higher level of capital management.

This also means that “one-time profits” are no longer a standard for measuring transaction levels, and “stable and proactive” has become a more scarce capability.

Platform mechanism makes it possible to “exchange capabilities for resources”

In China, some platforms are also trying to establish more standardized self-operated trading channels. For example, EagleTrader

The self-operated trading examination mechanism launched adopts a closed-loop assessment method of “two rounds of simulated fund assessment + strict risk control + profit sharing”, aiming to help traders accept real tests in the market environment without using their personal funds.

Traders who pass the exam will have the opportunity to obtain trading accounts of up to 80%-90% points, and in the event of excellent long-term performance, the possibility of obtaining trading seats and career positions provided by the platform.

The platform mechanism is becoming more mature, but the core is always – whether the capabilities are truly solid and whether the trading logic can stand the test of the market.

For many people, trading has never been a “stable job”, but with the evolution of institutions and mechanisms, it is indeed becoming a professional path that can be taken steadily.

If you already have a mature trading system, can withstand drawdowns, and are eager to use your strength to get growth and rewards, you may consider embarking on this “professional trader” path dominated by capabilities and spoken by data.

Not relying on luck, not on connections, but on understanding and control of the market – this is an era where value is defined by ability.