What is the underlying reason for the sharp rise and fall in the market? Is it really the news?

- 2025年12月1日

- Posted by: Eagletrader

- Category: News

In foreign exchange and other financial markets, price fluctuations appear to be driven by factors such as macroeconomic data, central bank actions, geopolitical situations or market sentiment. However, whether it is a financial market or any other market, the core and most essential driving force of prices is always the relationship between supply and demand.

When there are obvious fluctuations in the market, analysts usually explain it from fundamentals (such as breaking news), technical aspects (such as breaking through key support/resistance) or emotional aspects. But looking at the underlying logic, all price changes are due to the interaction of power between buyers and sellers – both parties are constantly bidding and counter-offering, trying to find a “reasonable” price for the asset in their minds. For Forex traders, this interaction can manifest itself in charts as trends or swing structures.

<img alt="" src="https://www.hudianbaoseo.cn/uploads/allimg/20251201/1764553713809240.jpg" width="654" height = 343 What really drives price movement is the "urgency" with which traders are willing to trade at a higher or lower price. When buyers are willing to raise the price to complete the transaction, the price goes up; when the seller is willing to lower the price to ship, the price goes down.

Understanding this “urgency” requires looking at two key dimensions: trading volume and liquidity.

Trading volume: reflects the true participation of the market

Trading volume represents the actual number of transactions in the market and is one of the most important indicators besides price.

High trading volume often means the possibility of large fluctuations.

This is because a large number of market orders entering the market will directly push the price to move quickly in a certain direction.

Huge trading volume at certain price levels often has support or resistance significance.

The market tends to return to these densely traded areas again.

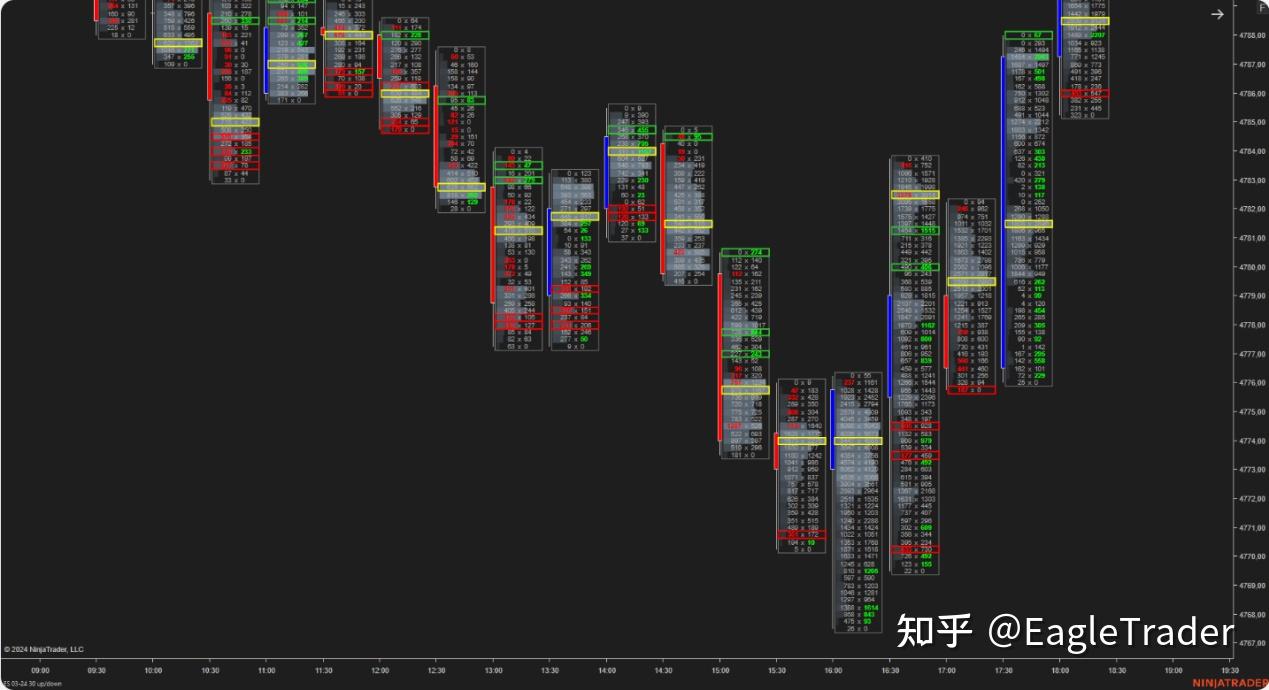

In addition to traditional trading volume indicators, professional traders often use Order Flow or Footprint Charts.

They show the actual volume of buyers and sellers at each price point:

The numbers on the left represent sell orders (weakening demand),

The numbers on the right represent buy orders (strengthening supply).

Such tools usually cannot be used in regular trading applications and require reliance on professional software, such as NinjaTrader.

Liquidity: determines whether the price can run “smoothly”

Compared with trading volume, liquidity can better explain the occurrence of short-term price jumps and slippages

Liquidity usually exists in the form of pending orders (limit orders), which can be observed through order book tools. However, since the foreign exchange market is an over-the-counter (OTC) decentralized transaction, it is difficult for ordinary traders to access this data directly from the application. They need to obtain it through brokers, third-party services or trading platform extensions, such as

Free Trader Ladder tool by NinjaTrader.

The impact of liquidity on price

When liquidity is sufficient:

Price fluctuates smoothly, transactions are easy to match, and slippage is less.

When there is insufficient liquidity:

Even if there is no obvious news, prices may jump quickly because there are not enough counterparty orders at certain price levels.

From experience, the most dramatic changes in prices tend to occur in

An area where both volume and liquidity are thin. In these areas, market participation is low, orders are sparse, and buyers and sellers cannot find matches quickly, so a small number of orders can drive violent price movements.

How do institutions and professional traders use this information?

It is often the traders with large funds who drive market trends. They will focus on the real-time changes in the following data:

Pending order density (liquidity) at different prices

The direction and size of market orders

Historical trading volume accumulation at specific prices

After understanding the power of supply and demand, trading volume and liquidity, traders will find that market fluctuations do not come from a single message, but are driven by the concentration and lack of participant behavior at different prices.A truly mature transaction requires continuous verification of these underlying logics in a stable environment.

At

In EagleTrader’s simulated real environment, traders can use mechanisms such as unified risk control and real market depth simulation to test whether the strategy can withstand key factors such as liquidity changes, trading volume differences and rapid price fluctuations. Many traders who have achieved stable performance have gradually formed their own trading systems in this environment that is close to real trading.

For traders who want to improve their practical capabilities, understanding the market structure is only the starting point. Putting the theory into a strict environment and verifying it repeatedly is the real path to growth.